A comprehensive guide for Investors: understanding the mechanics, diversity, and advanced bond selection tools

In the grand theatre of finance, where every instrument plays a specific role, bonds are the backbone of the system. They are the invisible bridge between those who have surplus capital and those who need it, the backbone of public and private debt, the foundation on which interest rates rest and, for many investors, the main way to diversify and protect portfolios. But at a time when the cost of money changes with the speed of central bank pronouncements, and when geopolitical and inflationary tensions rewrite the rules of the game, investing in bonds is anything but a trivial exercise.

The underlying mechanism: how bonds work

A bond is essentially a securitised loan, i.e. formalised in a negotiable security: the investor temporarily cedes capital to an issuing entity – which may be a sovereign state, a private or public company, or a supranational institution such as the World Bank – which contractually undertakes to return the entire capital on the pre-established maturity date, remunerating the investor in the meantime with periodic interest payments.

This interest, technically referred to as ‘coupons’ or ‘coupons’, constitutes the current yield component of the investment and can take various configurations: a fixed rate that is unchanging throughout the life of the loan, a variable rate pegged to a benchmark (such as Euribor or ECB rates), or more complex structures such as step-up/step-down coupons or indexed to inflation. The value of these coupons is not arbitrary, but reflects precisely the macroeconomic and market conditions at the time of issuance: in an expansive monetary policy environment with low rates, new issues will offer low coupons, while in tightening phases with high rates, newly issued bonds will provide more generous yields to attract capital.

This dynamic generates what is known as ‘rate risk’, one of the key elements affecting the value of bonds over time: a fixed-rate bond issued when rates were at 2% will become less attractive if market rates subsequently rise to 4%, as investors may earn higher returns with new issues. As a result, the market value of the lower-rate bond will fall, creating the inverse relationship between bond prices and interest rates that is a core principle of finance.

However, the bond ecosystem does not end at the moment of initial subscription (primary market): these financial instruments live a second life in the secondary market, where they are traded between investors at prices that fluctuate daily. These fluctuations reflect not only the evolution of interest rates, but also the perception of the issuer’s creditworthiness (the risk that it may not honour its commitments), inflationary expectations, market liquidity and even geopolitical events that influence investors’ appetite for risk. In this context, tools such as credit ratings (assigned by specialised agencies such as Moody’s, S&P and Fitch) provide standardised parameters to assess the issuer’s financial soundness, significantly influencing the risk premium demanded by investors.

The residual maturity of the bond, technically measured through indicators such as modified duration, also determines the sensitivity of the price to changes in interest rates: long-maturity bonds have larger price fluctuations than short-term bonds, configuring a completely different risk-return profile despite the apparently similar nature of the instruments.

A variegated universe: from sovereign to corporate, from inflation-linked to high yield

The bond landscape constitutes an extremely articulated ecosystem, comparable to a complex galaxy where financial instruments with profoundly heterogeneous characteristics coexist, each with structural peculiarities that determine their risk-return profile, liquidity and correlations with different macroeconomic variables.

At the centre of this universe are sovereign bonds, issued by sovereign governments to finance their public debt. These instruments, ranging from US Treasuries – considered the safe haven par excellence thanks to US economic power – to German Bunds – the Eurozone’s benchmark for financial solidity – to Italian BTPs, which are more sensitive to spread dynamics, represent not only investment opportunities but real indicators of the financial stability of individual countries. The yields of government bonds of AAA-rated countries (such as Germany or Switzerland) are considered to be approximately ‘risk-free’ and serve as a cornerstone for the construction of yield curves, a fundamental element for the valuation of all other financial instruments. The exceptional liquidity of these markets, with daily trading volumes in the order of hundreds of billions, allows institutional investors to quickly reallocate large assets without significantly impacting prices.

The corporate bond segment introduces a further dimension of complexity, forming a continuum of risk-return profiles that reflects the heterogeneity of the corporate fabric. Investment grade bonds, issued by companies with solid fundamentals and high credit ratings (BBB- to AAA), offer a modest yield premium over government bonds, while at the same time ensuring an extremely low statistical probability of default. These instruments, issued by industrial giants, regulated utilities or multinationals with predictable cash flows, represent the most conservative part of the corporate universe, suitable for investors with a low appetite for risk but willing to slightly increase yields over government bonds.

At the opposite end of the spectrum are high-yield bonds (or ‘junk bonds’), issued by companies rated below BBB- or even unrated. These instruments, which may be the product of companies undergoing restructuring, highly indebted companies following leverage buyouts, or highly leveraged companies in cyclical sectors, offer significantly higher yields – often several percentage points above investment grade bonds – as compensation for substantially higher credit risk. Analysing these securities requires specialised expertise in assessing not only company fundamentals, but also the specific contractual clauses (covenants) that determine investor guarantees and default conditions.

Inflation-indexed bonds constitute a distinctive category specifically designed to protect the real purchasing power of invested capital. These instruments – such as US Treasury Inflation-Protected Securities (TIPS), Italian BTP€is or UK index-linked gilts – incorporate a mechanism for automatically adjusting the nominal value or coupons to changes in inflation, as measured by official indices such as the CPI in the US or the HICP in the Eurozone. In times of accelerating inflation, these securities offer fundamental protection, which is particularly valuable for institutional investors with long-term inflation-sensitive liabilities, such as pension funds or life insurance companies.

One of the most distinctive and sophisticated segments is represented by perpetual bonds (or ‘consol’), characterised by the absence of a predefined maturity date. These hybrid instruments, which combine bond and equity features, are mainly issued by financial institutions as part of their Additional Tier 1 or Tier 2 regulatory capital, in compliance with Basel III prudential requirements. Investors receive potentially unlimited coupon flows over time, but have to accept special clauses such as the possibility of discretionary coupon suspension, the absorption of any losses (write-down) or forced conversion into equity (bail-in) in the event of an issuer crisis. The valuation of these instruments requires specific expertise in financial regulation as well as fundamental analysis.

Finally, the emerging market debt segment represents a frontier characterised by high potential returns accompanied by equally significant risks. These bonds, issued by both governments and corporations in developing economies – from Brazil to Indonesia, from Turkey to South Africa – offer substantial yield premiums that reflect not only the inherent credit risk, but also exposure to systemic risk factors such as political instability, institutional fragility, vulnerability to commodity shocks and, above all, currency risk, which is particularly relevant for securities denominated in local currencies. The periodic crises that hit these markets – from Argentina to Venezuela, from Russia to Turkey – testify to the volatile nature of these investments, which nevertheless can play an important role in the diversification of sophisticated portfolios due to their imperfect correlation with developed markets.

Investing in 2025 with the Bond Selector: an advanced tool for a tailored choice

Although it is possible to develop reasoning based on the macroeconomic conjuncture – by analysing, for example, the evolution of interest rates, inflationary dynamics and central bank decisions – the choice of the ideal bond remains a highly customised process, which must take into account the time horizon, risk appetite, liquidity needs and specific objectives of each investor. For effective targeting, it is essential to have a comprehensive database and an advanced filtering system that allows the characteristics of the most suitable bond to be identified in a targeted manner. FIDAworkstation, through its innovative Bond Selector, offers precisely this possibility.

The process begins with defining the selection universe – choosing from all the instruments available in the FIDA database, a customised list or the manual selection of bonds

The power of the filtering system

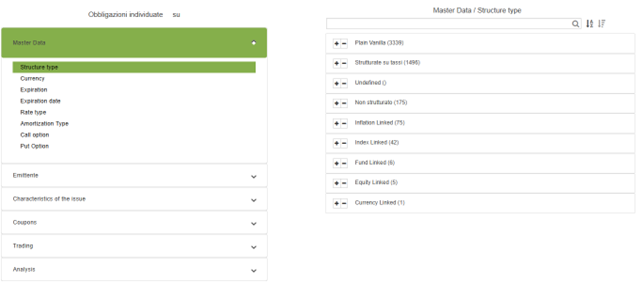

The bond selector provides an extremely sophisticated filtering system, capable of breaking down the bond universe based on essential detailed criteria. For instance, the “Structure Type” filter allows users to differentiate bonds according to their nature – distinguishing between plain vanilla bonds, rate-structured securities, and more exotic solutions such as inflation-linked or equity-linked instruments – facilitating the identification of securities that best align with the investor’s objectives. Similarly, the “Currency” filter enables bond selection based on monetary denomination, a crucial factor in managing exchange rate risk and integrating investment strategy on an international scale.

Additional parameters further enrich the analysis. For example, the “Maturity” filter allows users to select bonds based on their remaining duration – distinguishing between short, medium, and long-term securities – ensuring alignment with preferred investment horizons. The “Rate Type” filter, on the other hand, differentiates between fixed-rate, floating-rate, step-up coupon, zero-coupon, and other configurations, providing a detailed perspective based on expectations regarding interest rate movements. Lastly, the “Amortization Type” filter helps identify whether the principal repayment occurs in a single installment or is staggered – whether through constant, irregular payments or even specific customized structures – allowing for optimal cash flow management and risk profiling.

Source: FIDAworkstation

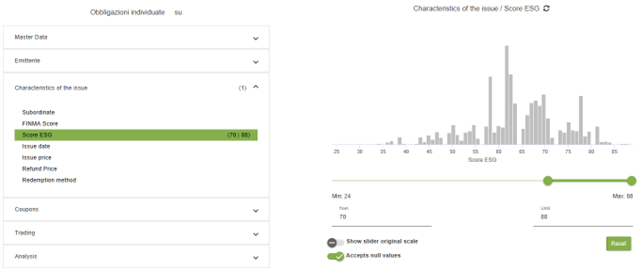

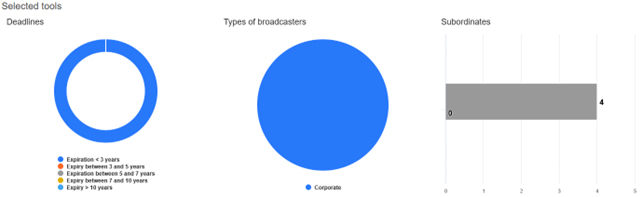

The choice based on the subordinated nature of a bond is crucial: identifying whether a security is subordinated, non-subordinated, or if such information is undefined allows for an assessment of the repayment priority in the event of adverse scenarios – an essential factor in credit risk management. Similarly, the repayment structure – whether through bullet maturity, amortizing payments, or undefined modalities – plays a key role in planning cash flows and calibrating the timing impact of financial commitments.

Source: FIDAworkstation

The coupon frequency provides additional tools to align income flows with liquidity needs and reinvestment strategies. On the trading front, factors such as the minimum lot size, the listing market – ranging from EUROTLX to MOT, Vorvel, or other venues – and the number of days since the last transaction serve as key indicators for assessing market liquidity and efficiency. These elements help mitigate the risk of investing in instruments with low trading activity, which could be challenging to liquidate quickly.

Source: FIDAworkstation

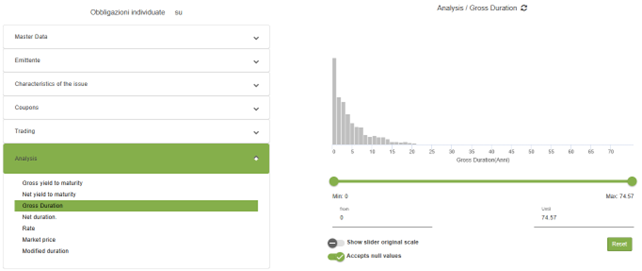

Finally, the quantitative characteristics under analysis – such as gross and net yield to maturity, duration, and market price – play a complementary role, enabling a thorough and comparative assessment once the bond’s qualitative profile has been defined. This logical sequence – from evaluating subordination, repayment structure, coupon frequency, and trading conditions to incorporating quantitative metrics – allows investors to build a portfolio on solid and coherent foundations. By fully leveraging the capabilities of the bond selector, they can navigate the vast and diverse bond universe with greater awareness and precision.

Source: FIDAworkstation

A mirror of the market offering

Beyond enabling targeted selection, the bond selector also reveals the overall structure of the bond market offering. For instance, in terms of “Structure Type,” plain vanilla bonds account for approximately 57% of the total, while rate-structured securities make up around 26%, with other categories holding only marginal shares. Similarly, currency analysis highlights the dominance of EUR-denominated bonds, which represent about 70% of the market, followed by USD-denominated instruments, covering nearly 19%, while other currencies are distributed across residual proportions. These percentages not only provide a comprehensive overview of the market’s diversity and breadth but also make the bond selector an essential tool for obtaining a clear and up-to-date picture of the bond landscape.

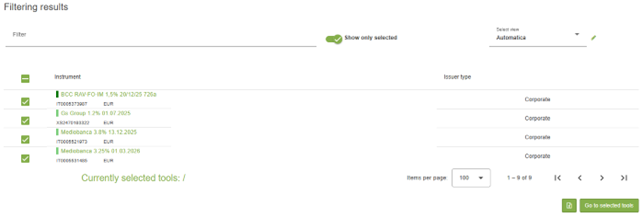

The Selected Bonds

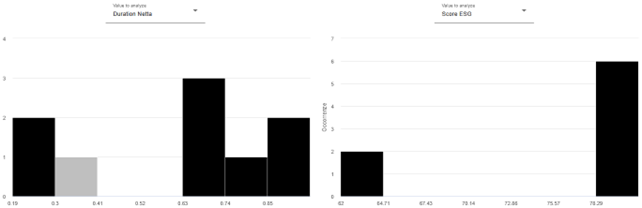

The results are presented in a graphical and interactive format, allowing investors to engage in a dynamic analysis of key variables. For example, users can visualize and adjust parameters such as the bond’s subordination status, the FINMA score assessing its solidity, the net yield to maturity as an indicator of expected returns, the net duration to gauge sensitivity to interest rate fluctuations, and the market price alongside the ESG score.

Source: FIDAworkstation

This intuitive interface also allows users to simulate the future coupon schedule, calculating cash flows year by year and enabling the assignment of customized weightings to each bond. In doing so, the bond selector transforms complex data into instantly accessible visual insights, supporting strategic investment decisions and enabling a tailored portfolio optimization.

Source: FIDAworkstation

This modular and flexible approach allows investors to refine their investment strategy with precision, turning the complexity of the bond market into a manageable and transparent opportunity.

Monica F. Zerbinati

![]()

Request the free trial by emailing welcometeam@fidaonline.com